greenville county property tax rate

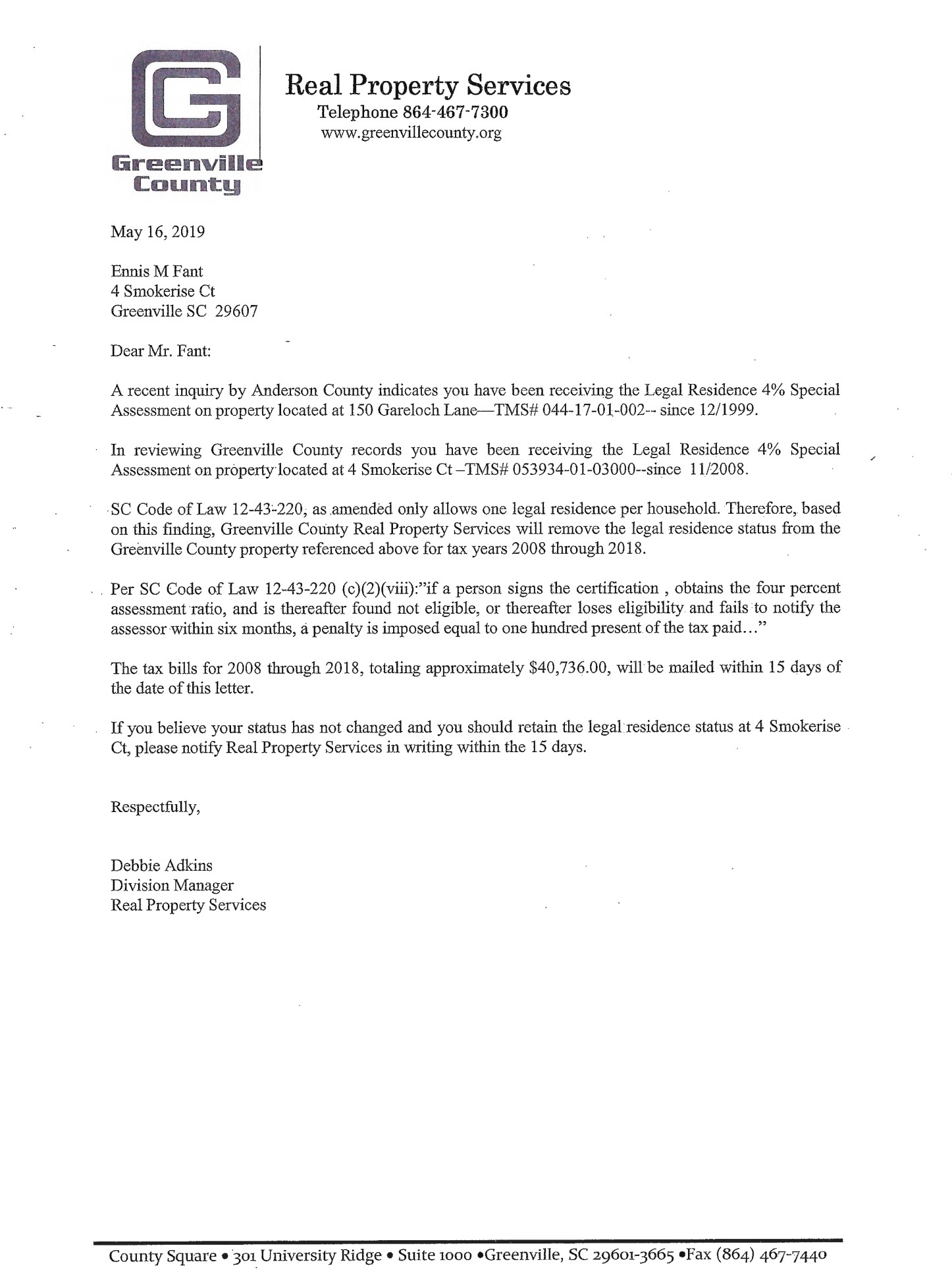

The median property tax on a 14810000 house is 97746 in Greenville County. Contact the Real Property Services Division at Greenville County Square Suite 1000 or call 8644677300 to obtain the proper forms.

Moving To Greenville Sc 10 Things You Ll Love About Your Move To Greenville Sc

For more details about taxes in.

. Get a Paid Property Tax. What this means is that if the marketappraisal value of your property is. The department analyzes researches and processes deeds and plats annually to keep its database.

We accept electronic check as well as credit and debit card payments through the Internet for ALL types of taxes including vehicle taxes. City of Greenville - 111945. Greenville County Tax Collector SC 301 University Ridge Suite 700 Greenville SC 29601 864-467-7050.

The exception occurs when you allow a dealer to obtain your license tag. If paying by mail please make your check payable to Greenville County Tax Collector and mail to. Greenville County Auditor 301 University Ridge Suite 800 Greenville SC 29601.

301 University Ridge Suite 1000. Customarily this budgetary and tax rate-setting exercise is. Pay Your Greenville County Tax Collector SC Tax.

Greenville County Real Property Services. The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100. Under a combined tax bill almost all sub-county entities arrange for Greenville County to levy and collect the tax on their behalf.

The median property tax on a 14810000 house is 74050 in South Carolina. 864 467 7300 Phone. Please Enter Only Numbers.

Taxes are payable at the Greenville County Tax. Search for Voided Property Cards. Hotel tax is imposed and collected by the City of Greenville.

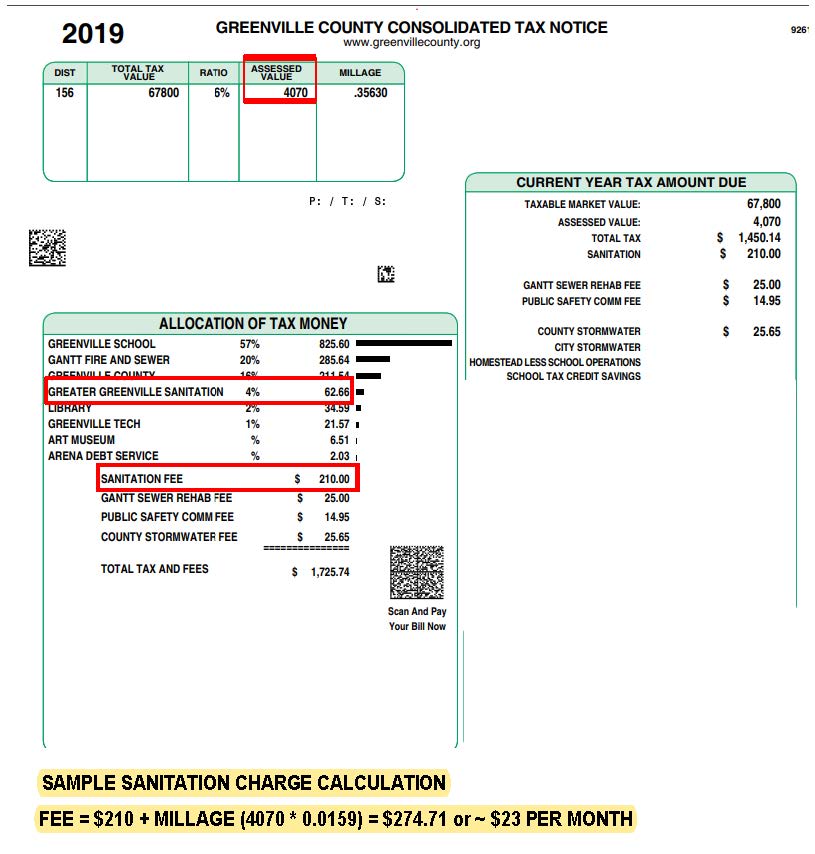

SC assesses taxes at a 4 rate for owner-occupied homes and at a 6 rate for other properties. Greenville SC 29604 Details Type. If your vehicle is improperly qualified or you are uncertain whether your vehicle would be eligible for car tax relief because it is used part of the time for business purposes.

The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of. Greenville County collects on average 066 of a pro. The median property tax on.

We also accept tax payments over the telephone. 04 Nov 2004 Seller Nancy Ferguson Buyer Ferguson Nancy life-estate 3 Ridge St Greenville SC 29605. Final taxes are obtained by adding special assessment which is a flat rate levied for services like sanitation and storm water.

Tax Collector Suite 700. Paying Personal Property Taxes - You must pay one 1 year in advance in order to obtain a license tag. 50 on overnight stays within the City of Greenville.

Located in northwest South Carolina along the border with North Carolina Greenville County is the most populous county in the state and has property tax rates higher. Greenville South Carolina 29601. 005 - HORSE CREEK DUNKLIN FIRE.

The Real Property Services Office values over 222034 properties in Greenville County. Please Enter Only Numbers.

2022 Best Places To Buy A House In Greenville County Sc Niche

Why Land Values Are Rising In Greenville County South Carolina

Why Retire In Greenville South Carolina

South Carolina Property Tax Calculator Smartasset

Fees Annexation Greater Greenville Sanitation

How Greenville County Assesses Taxes The Home Team

Greenville County Sc Councilman In Hot Water Over Taxes Fitsnews

Greenville County Council Candidates Answer Our Questions Bike Walk Greenville

Tax Rates Hunt Tax Official Site

Ultimate Guide To Understanding South Carolina Property Taxes

Greenville Sc Real Estate Market Stats Trends For 2022

What Does Annexing Actually Mean For Greenville And You Gvltoday

Want To Rent Your House Well You Re Going To Have To Pay Up Greenville Journal