nj ev tax credit 2022

C40 Recharge Pure Electric. Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as 12500 off the sticker price of their cars depending on the make and model.

These Electric Cars Deliver The Most Bang For The Buck

Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA.

. The EV tax credit is currently a nonrefundable credit so the government does not cut you a check for the balance. The credit ranges between 2500 and 7500 depending on the capacity of the battery. In June 2021 New Jerseys Clean Energy Program NJCEP allocated a total of 7 million for Fiscal Year 2022 dedicating 6 million for use by state.

Updated 1212022 Latest changes are in bold Other tax credits available for electric vehicle owners. As it stands now the current EV tax credit gives a base amount of 2500 for a four-wheel vehicle propelled by a battery at least a 4 kWh battery and is charged by an external source ie plug-in. President Bidens EV tax credit builds on top of the existing federal EV incentive.

XC40 Recharge Pure Electric P8 AWD. The base minimum credit is increased to 5000 in 2026 Senate version or 4000 in 2022 House version. But when combined with the federal tax credit of up to 7500 EV drivers in the Garden State can get as much as 12500 off.

ChargEVCs analysis finds that we will need 40 million in additional funding to keep the program open through the end of the current state fiscal year June 30 2022 and stay on track to hit our goals. New Jerseys EV law provides the BPU with budget flexibility in its establishment of the rebate program. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

Standard and Charge Ahead Rebates can be combined for up to 7500 toward the purchase or lease of a new eligible vehicle. What Is the New Federal EV Tax Credit for 2022. Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022.

TRENTON - The New Jersey Board of Public Utilities NJBPU opened Year 2 of its Charge Up New Jersey electric vehicle EV incentive program today taking one more step toward the Murphy Administrations goal of getting 330000 EVs on the road by 2025. So now you should know if your vehicle does in fact qualify for a federal tax credit and. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

The amount of the credit will vary depending on the capacity of the battery used to power the car. 7500 Purchase an electric or plug-in hybrid vehicle defined as a car with a battery capacity of at least 40 kilowatt-hours and a gas tank if any under 25 gallons. CLE credit in CA FL IL NJ NY PA TN TX and VA is currently pending approval for live viewings only.

The average transaction price for an EV was 56437 in Nov. View past and upcoming presentations here CLE credit. 2500 towards the purchase or lease of a new or used battery electric or plug-in hybrid electric vehicle.

Vehicles and create credits of up to 4000 for used vehicles. Biden would increase the current 7500 EV tax credit to up to 12500 for union-made US. An Act providing for bill credits to certain organizations against charges for their electric gas and water service and supplementing Title 48 of the Revised Statutes.

Lets say you owed the federal government 10000 in taxes when filing your 2021. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles. Local and Utility Incentives.

State and municipal tax breaks may also be available. Heres how you would qualify for the maximum credit. Electric Vehicles Solar and Energy Storage.

The Charge Up New Jersey Program has been successful for the second year in a row with allocated funding expected to dwindle by the end of the week. Thats about 10000 higher than the. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit.

If you purchased a Nissan Leaf and your tax bill was 5000 that. At least 30 million per year for 10 years. 5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission vehicles ZEVs which are vehicles certified pursuant to the California Air Resources Board zero emission standards for the model year.

New Jersey just restarted its electric vehicle incentive program. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer. You cant time anything based on Congress.

Beginning Today Customers Can Receive up to 5000 Incentive at the Point of Purchase. Most of the models you can order right now deliver in 2022 anyway. The exemption is NOT applicable to partial.

The provisions of any law rule regulation or order to the contrary notwithstanding each electric gas and water public utility as defined. Be It Enacted by the Senate and General Assembly of the State of New Jersey. 2021 according to Kelley Blue Book.

The deadline to order purchase or lease an eligible electric vehicle is 900 pm. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. New Jerseys Energy Master Plan outlines key strategies to reduce energy consumption and emissions from the transportation sector including encouraging electric vehicle adoption electrifying transportation systems leveraging technology to reduce emissions and miles traveled and prioritizing clean transportation options in underserved communities to reach the.

You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. The bill would also again make GM and Tesla Inc eligible for tax credits after they hit the 200000-vehicle cap on the existing 7500 credit. Theyve been screwing around with this EV.

The 2022 program is designed to provide a comprehensive overview on a variety of topics related to clients in the automotive and mobility industry. Prior to Jan. ET on Wednesday September 15 2021.

Timing when Congress will come together to pass anything right now is as good as timing the market itself.

All New 2022 Hyundai Ioniq 5 Ev Freehold Hyundai

Home Drive Green Air Quality Energy And Sustainability Aqes Department Of Environmental Protection

Electric Vehicles In New Jersey Fette Ford

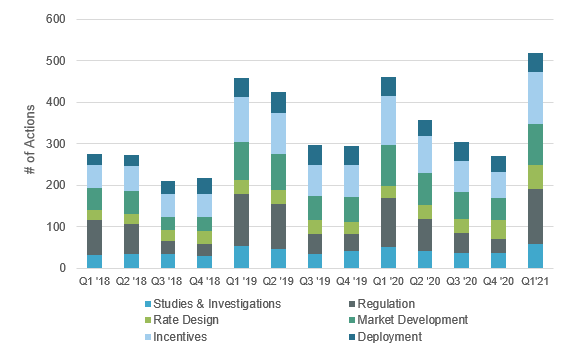

The 50 States Of Electric Vehicles State Lawmakers Focus On Incentives Fees And Government Procurement In Q1 2021 Nc Clean Energy Technology Center

Best Kia Niro Lease Deals Specials Lease A Kia Niro With Edmunds

2022 Kia Niro Ev Prices Reviews And Pictures Edmunds

New Jersey Electric Car Dealer New Used Kia Dealership

Ev Federal Tax Credit Bmw Of Bridgewater

Where Is The 2022 Kia Sorento Available In Hackettstown Nj Motion Kia

New Jersey Electric Car Dealer New Used Kia Dealership

2022 Hyundai Tucson Hybrid For Sale In Paramus Nj Paramus Hyundai

2022 Kia Niro Ev Prices Reviews And Pictures Edmunds

Order The 2022 Kia Niro In Hackettstown Nj

2022 Kia Seltos For Sale In Sicklerville Nj Turnersville Kia

5000 Rebate For Nj Electric Vehicle Signed Into Law Page 5 Tesla Motors Club

Volvo Electric Vehicle Special Offers Prestige Volvo Cars Englewood